This may surprise you but your Social Security statement does not reflect any reduction in benefits due to this provision. The Social Security Administration will wait until you file to tell you how much the reduction is if you qualify for both Social Security and a non covered pension.

Understanding if a reduction in benefits will apply to you, and how much that will be, does not have to wait until you file for Social Security. You can find out today. It starts by understanding the mechanics of the Windfall Elimination Provision.

The Social Security Amendments of 1983 introduced the Windfall Elimination Provision (WEP) as part of an effort to keep individuals from “double dipping.” This was defined as receiving both a pension from a job where they did not pay Social Security taxes and a Social Security benefit.

This new provision began to reduce Social Security benefits for those who worked in a job in which:

1) They did not pay Social Security taxes

and

2) Qualified for a pension from that job

and

3) Worked at another job where they qualified for Social Security benefits.

Teachers are one of the most common groups to be impacted by this rule but it often includes other public sector workers like firefighters, police officers and numerous other state, county and local employees.

In the beginning, Social Security didn’t cover any public sector employees. However, over the years, many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration. However, there are still several states who do not participate in Social Security. Instead, they have their own state-run pension plan. For workers in these states, the rules for collecting a non-covered government pension and Social Security can be confusing and maddening.

That’s especially true if you’ve paid into the Social Security system for enough quarters to qualify for a benefit. It’s quite common too. Many individuals find themself in this situation for a variety of reasons. For example, Firefighters often work second jobs where they pay social security tax. Police Officers will often retire at an early age and move on to another “covered” job. Many teachers came to education as a second career, after they’d spent years working in a job where Social Security taxes were withheld.

The Windfall Elimination Provision (WEP) is simply a recalculation of your Social Security benefit if you also have a pension from “non-covered” work (no Social Security taxes paid). The normal Social Security calculation formula is substituted with a new calculation that results in a lower benefit amount.

Covering the topic exhaustively would require a multipage essay, but the necessary components of the WEP can be distilled to a few simple points:

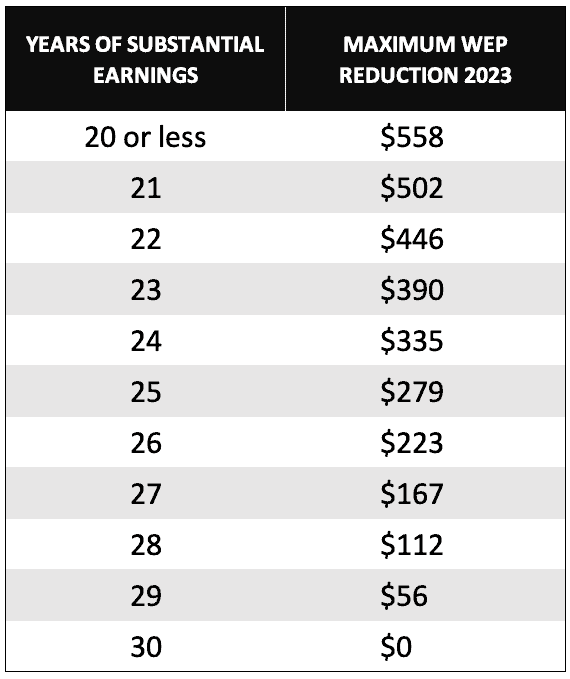

Source: Devin Carroll, Data: Social Security Administration

This phase-out of the WEP reduction offers an incredible planning opportunity if you have worked at a job where you paid Social Security tax. For example, if you worked as an engineer for 20 years before you began teaching, you may be able to do enough part time work between now and when you retire to completely eliminate the monthly WEP reduction. This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax.

Would it be worth it to work a little more to get full Social Security benefits? If you consider how much more in benefits you could receive over your retirement lifetime, it could be worth $100,000 or more in extra income over a 20-year retirement! Obviously, not everyone has the option of accumulating enough years to wipe out the big monthly WEP reduction. But for those who do, or can get close, it’s worth taking a closer look.

Below is a chart of the substantial earnings by year which would be required to sidestep the WEP.

For more information, see the Social Security Administration’s WEP Benefit Calculator.

When Social Security benefits are calculated, the SSA inflates your historical earnings, takes your highest 35 years of earnings and divides by 420 (the number of months in 35 years). This gives them the inflation-adjusted average indexed monthly earnings that are then applied to the formula which is made up of income brackets. The result of this formula is your primary insurance amount (PIA) which is also known as your full retirement age benefit.

If you have a pension from work where no SS was paid, your benefits are calculated on an alternate formula. The result of this alternate formula is a lower benefit amount.

At first glance, this alternate formula looks nearly identical to the ‘normal’ formula. However, upon closer inspection, you’ll notice that the earnings in the first bracket are credited to your final Social Security benefit at 40% instead of the 90% found in the normal formula.

There are a few circumstances where the application of the Windfall Elimination Provision will end. The result is a recalculation of benefits using the ‘normal’ calculation formula.

Here’s the section of the SSA website that discusses the circumstances of this recalculation.

The WEP computation is no longer used when:

The most notable point is when an individual who is subject to the WEP dies. In this case, the survivor’s benefit is recalculated without the WEP.

For example, before Dave became a Texas teacher he worked for a large retailer for 19 years. Because of his teacher’s pension his SS benefit was subject to the alternate WEP calculation. What should have been a $1,500 SS benefit became a $1,100 benefit. Unfortunately, Dave died at 70. His wife fully expected to receive his $1,100 SS benefit as her widow’s benefit, but instead she found out that her benefit would be closer to $1,500. This was because the WEP penalty was removed when Dave died.

So what happens if you file early? Your benefit amount is reduced due to your age, but does the WEP penalty decrease as well? The same question could be asked if you wait until beyond your full retirement age to file. Will your penalty amount increase? The Social Security Administration has a page where they discuss this, but it is not clearly written (no surprise).

Here’s what happens to your Windfall Elimination Provision penalty if you file before or after your full retirement age.

The Windfall Elimination Provision reduces your benefit amount before it is reduced or increased due to early retirement or delayed retirement credits. It is this WEP-reduced benefit that is increased, or decreased, due to filing age.

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. You CAN simplify these rules and get every dime in benefits you deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 400,000 subscribers on my YouTube channel!